Hsa Contribution 2024 Over 55. The amount individuals and couples who are 55 and older and not yet on medicare can contribute to an hsa will climb to $5,150 and $10,300, respectively. Determine the maximum amount the irs allows you to contribute towards your hsa for this next year.

For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual. Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

The New 2024 Hsa Contribution Limit Is $4,150 If You Are Single—A 7.8% Increase From The Maximum Contribution Limit Of $3,850 In 2023.

Under the new guidelines announced this week, for folks under 55, individuals can contribute up to $4,150 annually to their hsas, nbc news reported.

Hsa Contribution Limits For 2023 Are $3,850 For Singles And $7,750 For Families.

The hsa contribution limit for family coverage is $8,300.

This Additional Contribution Amount Remains Unchanged From 2023.

Images References :

Source: blog.threadhcm.com

Source: blog.threadhcm.com

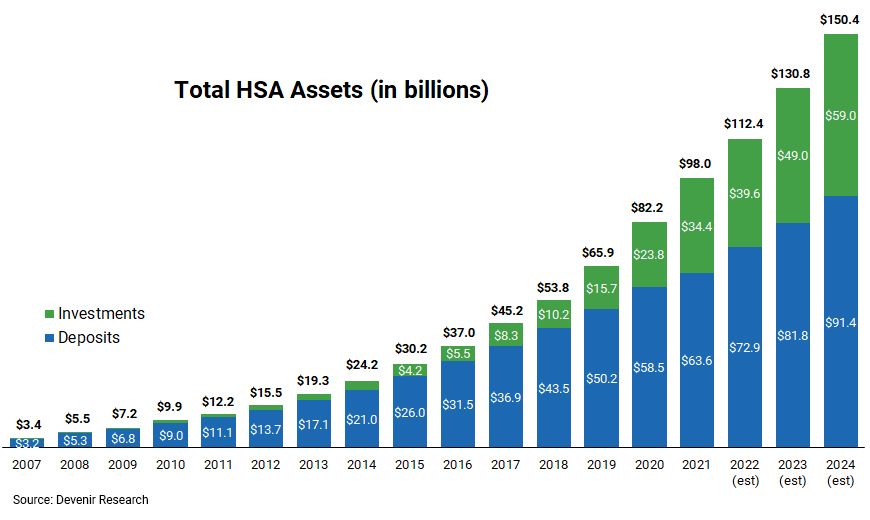

IRS Announces 2023 HSA Contribution Limits, Hsa members can contribute up to the annual maximum amount that is set by the irs. Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2024 Renie Delcine, On may 16, 2023 the internal revenue service announced the hsa contribution limits for 2024. The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation.

Source: admin.itprice.com

Source: admin.itprice.com

2023 Dcfsa Limits 2023 Calendar, The amount individuals and couples who are 55 and older and not yet on medicare can contribute to an hsa will climb to $5,150 and $10,300, respectively. Increases to $4,150 in 2024, up $300 from 2023;

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Individuals who are 55 or older may be able to contribute an additional $1,000 to their hsa in 2024. Determine the maximum amount the irs allows you to contribute towards your hsa for this next year.

Source: www.plansponsor.com

Source: www.plansponsor.com

IRS Raises HSA Contribution Limits for 2024 Due to High Inflation, In may, the irs announced a significant increase to the annual hsa contribution limit for 2024. On may 16, 2023 the internal revenue service announced the hsa contribution limits for 2024.

Source: w2023d.blogspot.com

Source: w2023d.blogspot.com

2023 Hsa Contribution Limits Irs W2023D, For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

Source: bellqcelestyna.pages.dev

Source: bellqcelestyna.pages.dev

Federal Hsa Limits 2024 Renie Delcine, What is the hsa contribution. Under the new guidelines announced this week, for folks under 55, individuals can contribute up to $4,150 annually to their hsas, nbc news reported.

Source: calcpahealth.com

Source: calcpahealth.com

2023 Health Savings Accounts Limits Are Released By The IRS CalCPA, Increases to $4,150 in 2024, up $300 from 2023; In may, the irs announced a significant increase to the annual hsa contribution limit for 2024.

Source: fischfinancial.org

Source: fischfinancial.org

Increase in 2023 HSA Contribution Limits Fisch Financial, Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families. The irs annually evaluates limits and thresholds for various benefits and provides increases, as needed, to keep pace with inflation.

Source: passiveprince.com

Source: passiveprince.com

40 Passive Revenue Concepts For 2023 To Construct Actual Wealth, Hsa contribution limits for 2024 are $4,150 for singles and $8,300 for families. Hsa contribution limit employer + employee:

The Hsa Contribution Limit For Family Coverage Is $8,300.

Determine the maximum amount the irs allows you to contribute towards your hsa for this next year.

Individuals Who Are 55 Or Older May Be Able To Contribute An Additional $1,000 To Their Hsa In 2024.

The maximum contribution for family coverage is $8,300.