Roth Ira Contribution 2024 Income Limits Married Filing Jointly. — the exception is if your joint income is now higher than the income limits for roth iras set by the internal revenue service (irs) for couples filing jointly: — the roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

— a full deduction up to the amount of your contribution limit: — the exception is if your joint income is now higher than the income limits for roth iras set by the internal revenue service (irs) for couples filing jointly:

Roth Ira Contribution 2024 Income Limits Married Filing Jointly Images References :

Source: doreyynalani.pages.dev

Source: doreyynalani.pages.dev

Limit For 2024 Roth Ira Contribution Jessie, For couples with incomes above $230,000, contribution limits begin to phase.

Source: jeanninewetti.pages.dev

Source: jeanninewetti.pages.dev

Roth Ira Limits Married Filing Jointly 2024 Kassi Matilda, If you're covered by a retirement.

Source: barbyelladine.pages.dev

Source: barbyelladine.pages.dev

Roth Limits 2024 Married Filing Joint Dehlia Glynnis, Start with your modified agi.

Source: estherann-marie.pages.dev

Source: estherann-marie.pages.dev

Roth Ira Contribution Limits 2024 Married Filing Jointly Dorri Germana, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute to a roth ira, and if you’re married and filing.

Source: jeanninewetti.pages.dev

Source: jeanninewetti.pages.dev

Roth Ira Limits Married Filing Jointly 2024 Kassi Matilda, Each spouse can have their own roth ira, allowing both to contribute.

Source: denyyodetta.pages.dev

Source: denyyodetta.pages.dev

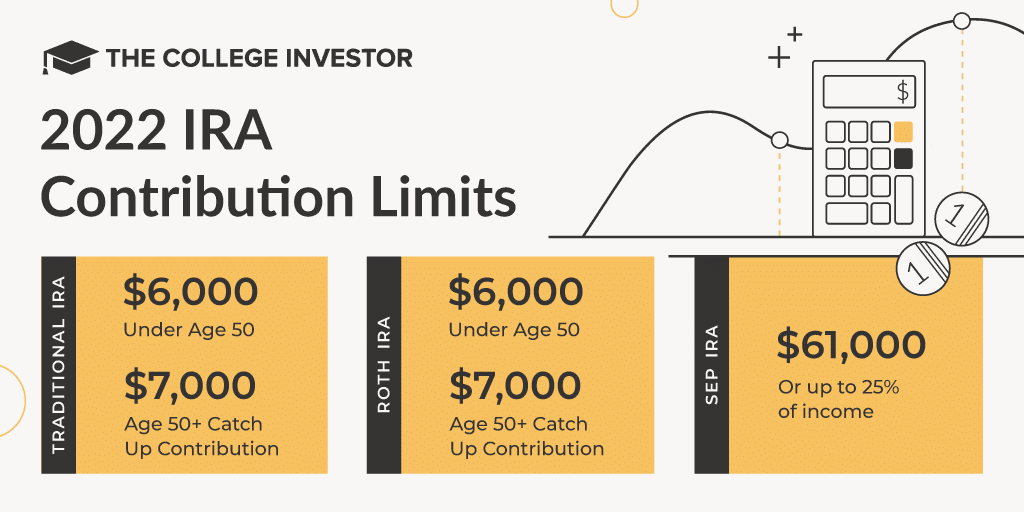

Roth Ira Limits 2024 Married Filing Jointly Irs Shela Dominica, — the ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024.

Source: karleenwclovis.pages.dev

Source: karleenwclovis.pages.dev

Ira Contribution Limits 2024 Married Filing Jointly Allys, If you are married and filing jointly, the limits are $230,000 and.

Source: agathebgilbertina.pages.dev

Source: agathebgilbertina.pages.dev

Roth Married Limits 2024 Belva Katleen, — couples are eligible to make a roth ira contribution until their adjusted gross income is between $230,000 and $240,000.

Source: arethaqmaggie.pages.dev

Source: arethaqmaggie.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Karla Marline, Married filing jointly or qualifying widow(er) and you're covered by a plan at work:

Source: joyayfrancyne.pages.dev

Source: joyayfrancyne.pages.dev

Roth Ira Limits 2024 Married Filing Jointly In India Thea Sadella, — contributions begin phasing out above those amounts, and you can't put any money into a roth ira once your income reaches $161,000 if a single filer or $240,000 if married and filing jointly.